Although Nationwide's protection is much more expensive than the majority of the various other firms on the listing, this firm does use some of the lowest research prices for motorists with low credit rating. Of the business on this list, the representative insurance prices from Progressive are the 5th lowest. Based on the motorist profiles made use of, the study price is $1308 each year.

Much More Costly Car Website link Insurance Provider, In our evaluation, the car insurance coverage rates provided by Farmers are significantly greater than average. insurance companies. The research study rate is $1538 annually, making Farmers the second-most pricey business in our research. We found that State Farm is the second-most pricey overall among the 9 significant automotive insurance provider on the checklist (insurance).

It is virtually $900 above the rate from USAA, the most inexpensive automobile insurance business in our research study. Regional as well as Local Business, When comparing automobile insurance coverage rates, it's crucial to be mindful that not all firms offer insurance throughout the nation.

, look for price cuts with the various insurance coverage business (low cost auto). You can ask your insurance agent concerning what discounts are available, as the business might use price cuts that you are eligible to obtain yet are not taking benefit of on your policy.

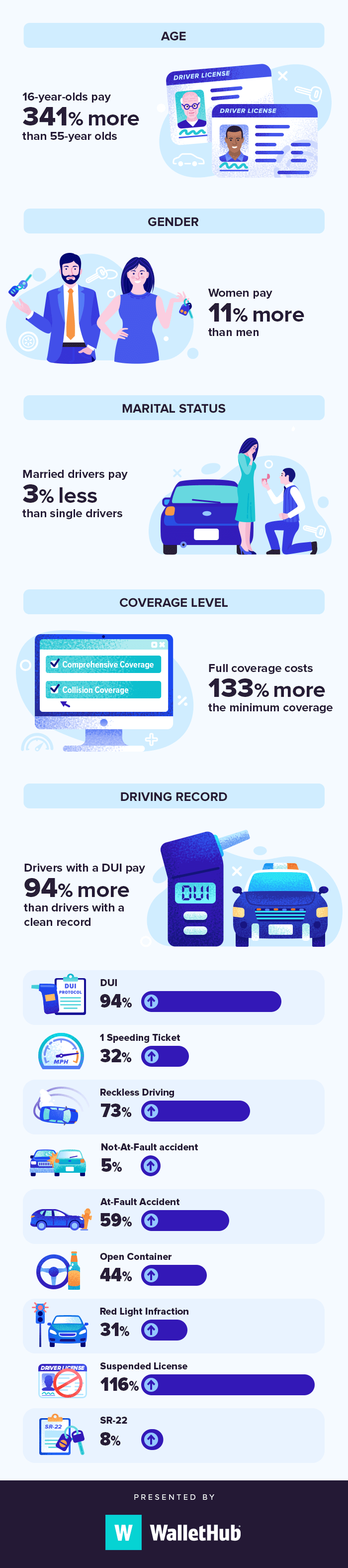

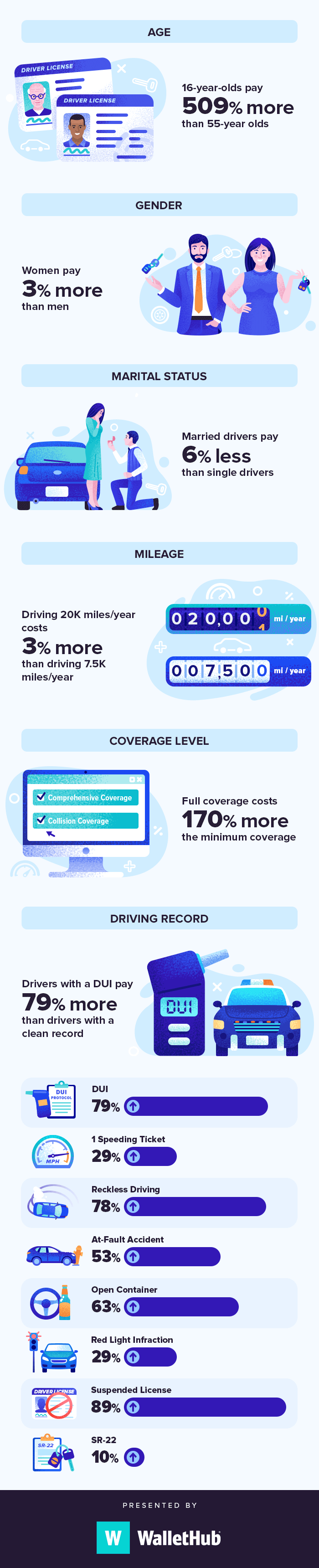

When asking for car insurance coverage prices quote from numerous suppliers, make certain to ask for all discount rates that are readily available to you. Traffic Offenses and Insurance Prices, When a vehicle driver account has one speeding ticket, the research study prices start to increase. This relationship results from the fact that drivers who speed are most likely to be associated with crashes.

low cost auto cheaper car dui insurance

low cost auto cheaper car dui insurance

cheap car insurance auto affordable cheap insurance

cheap car insurance auto affordable cheap insurance

If a motorist profile has a mishap, the rates boost also a lot more. USAA is still the lowest-priced alternative for motorists with a crash, but their rates increase by around $320 each year over a vehicle driver without an accident on their record. The ordinary boost in the research prices for drivers with a crash throughout all business on the listing is $300 annually.

Some Known Facts About Geico May Have To Pay $5.2 Million To A Woman Who ... - Npr.

This is since chauffeurs who drive while intoxicated go to an extremely high threat of triggering an accident. The motorist profile utilized in our study with a drunk driving showcases exactly how certain insurer penalize this violation greater than others (auto insurance). Geico is the second-cheapest overall in our evaluation, the prices for the profile with a DUI are some of the highest in the research.

money auto insurance cheaper auto insurance

money auto insurance cheaper auto insurance

The profiles utilized in our study with good credit report received an ordinary price of $1306 each year, while the average yearly price for profiles with inadequate credit score was $2318. Info and research in this short article validated by ASE-certified Master Specialist of - cheaper car insurance. For any kind of feedback or modification demands please contact us at.

dui liability car insurance cars

dui liability car insurance cars

You may be able to discover more information about this and also comparable material at. car insurance.

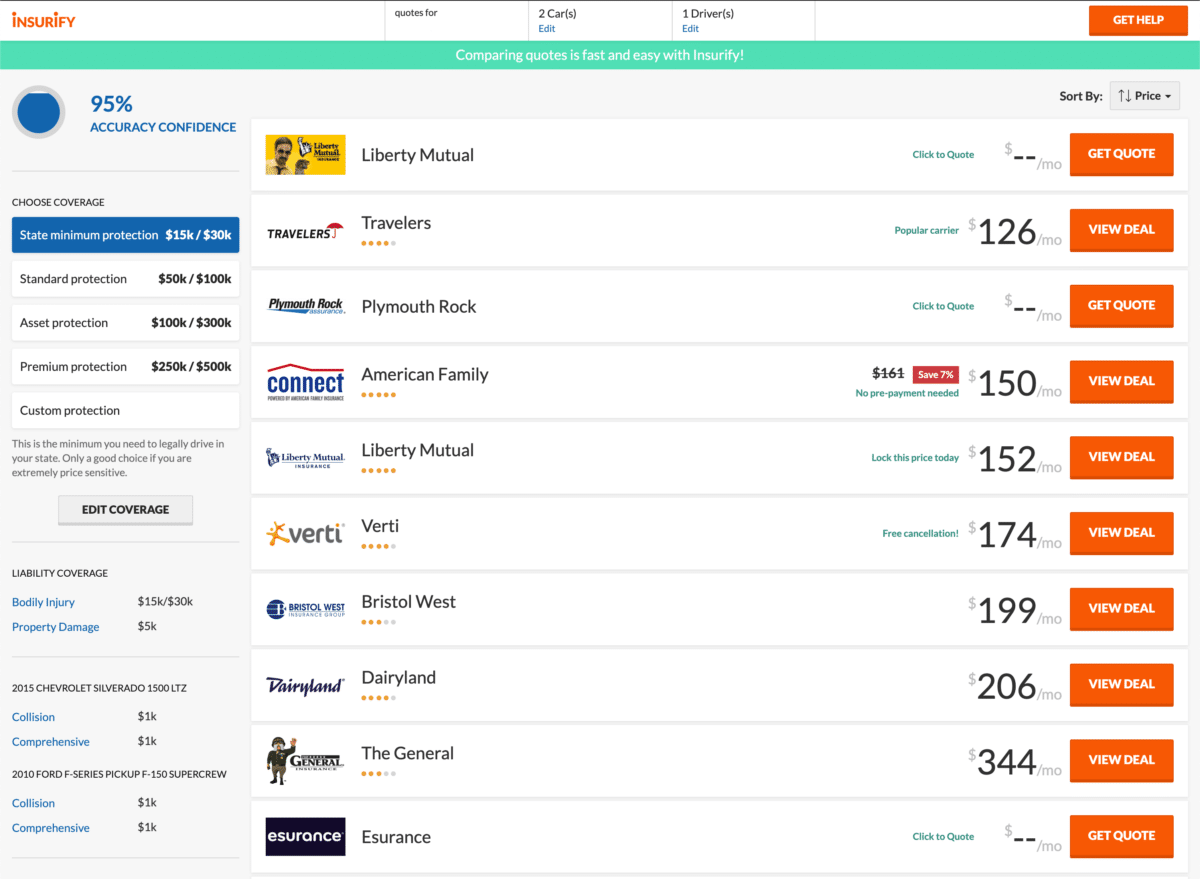

Two of the most affordable vehicle insurer at a national degree are GEICO and USAA. Other cheap car insurance coverage options include smaller insurance companies like Grange and also Erie. You need to collect insurance coverage quotes from several insurers to locate the cheapest plan.

cars insurance affordable car insurance cheap car

cars insurance affordable car insurance cheap car

When looking for the cheapest vehicle insurance, you could start with USAA, Erie Insurance Coverage, Root Insurance Policy, Geico, and also State Farm. Based on our comprehensive study, these business all offer affordable rates.

In addition to the insurance company you select, elements such as your age, lorry, and also driving history can influence your premium. What Is The Cheapest Automobile Insurance Policy Company?

About Aflac - America's Most Recognized Supplemental Insurance ...

Finest Inexpensive Auto Insurance Policy Suppliers In our study of the cheapest auto insurance coverage companies, we located a number of companies with reasonably reduced prices (trucks). While a few other cars and truck insurer supply low-cost car insurance coverage, we are mosting likely to concentrate in this write-up on the 5 stated above. These service providers have the best prices for minimum vehicle insurance coverage in addition to the most affordable full coverage insurance policy. cheap car.

Power Vehicle Insurance Research recommends Erie is a leader anywhere protection is sold - affordable.: You live in a protected state You have had an at-fault crash Your credit score is exceptional For more information regarding this low-cost vehicle insurance carrier, examine out our Erie automobile insurance coverage evaluation. # 3 Origin Insurance: Finest Usage-Based Insurance Coverage Origin Insurance Coverage Pros Root Insurance coverage Cons Excellent rates for great vehicle drivers May refute coverage based upon your driving actions Whatever is done with a mobile app, creating a straightforward quotes as well as cases process Just available in 29 states Includes roadside help No personal insurance representatives designated to your plan A+ rating from the BBB Young business contrasted to others in the market Root Insurance coverage is a little bit different from other insurance providers - affordable.

To get a quote from Root Insurance coverage, your driving actions initially has actually to be tape-recorded with the Origin mobile application, which can take a pair of weeks. Because Origin provides insurance coverage only to good chauffeurs, it pays out much less usually, making it one of the cheapest cars and truck insurance coverage carriers. However, Root can reject protection if you aren't an excellent vehicle driver.

While Geico might not be the most effective selection for somebody with an erratic driving record, secure motorists discover a great deal of advantages being used the service provider. Benefits offered by Geico include roadside support, ridesharing insurance policy, as well as mechanical breakdown insurance coverage. Additionally, the firm has an A+ rating from the BBB, plus it scored very in the J.D.However, State Farm is not rated by the BBB at this time. State Ranch uses Drive Safe & Save Discounts to help you keep even more cash in your pocket. By taking part in the program, you can save approximately 30 percent. The program is easy to utilize as well as can be performed from On, Celebrity or your smartphone.